VA Maximum Loan amount limit for the 2020 Calendar Year is $510,400 in most areas (see below for more). This represents the loan amount that is subject to VA’s Conforming Loan amount guidelines. Any loan amount over that is subject to VA JUMBO rules. VA Jumbo loans over your area’s maximum limit are available.

Check out this exciting news for opens in a new windowupdated down payments on VA JUMBO Loans in 2020.

Most Counties Maximum VA loan limit equals $510,400 for 2020 including Maricopa County. However, Counties considered “High Cost” have a higher Maximum VA loan limit for 2019 and are listed further down on this page.

Maximum VA Loan Amount 2020

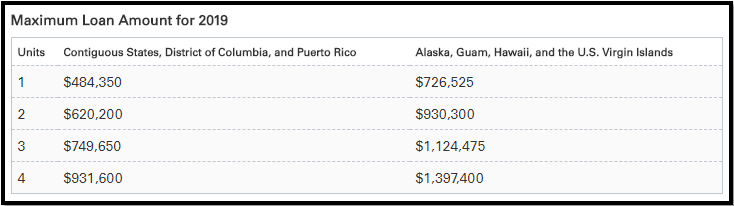

The Maximum VA Loan Amount for the 2020 Calendar year is $510,400 in most areas for a 1 unit single family home. Maximum VA Loan Limits for 1,2,3 and 4 unit properties are listed in the table below for non-high cost areas. High Cost Area Maximum VA Loan Amounts for 2020 are further down on this page.

VA Max Loan Limit County Search

VA loan limits are based off county median home values estimated by the Federal Housing Finance Agency’s (FHFA). These values are the basis for which VA calculates limits for their Maximum Home Loan Amount. ( opens in a new windowVA Official Website).

Arizona VA Loan Resources:

VA Mortgage Overview VA Property Requirements VA Loan Eligibility (COE) VA Closing Cost Rules opens in a new windowVA Non Allowable Fees VA Funding Fee VA Streamline Refinance Team Phone: 602.435.2149 Team Email: Team@JeremyHouse.com By Jeremy House Google