Mortgage Approval: Documenting Deposits

Today’s mortgage guidelines require that a borrower explain and document any “large and unidentified deposits” that appear on their asset statements. Documenting these deposits up front with The HOUSE Team prior to your loan being submitted into underwriting for final approval will save you time delays and avoid closing late as the underwriter reviewing your file will ultimately issue an approval with a condition that the borrower explain and document large deposits not properly documented ahead of time.

What is a “Large Deposit?”

The Large Deposits that need to be documented are those that are:

1. Not identified as payroll deposits, tax refund deposits, social security/retirement income deposit

2. Exceed underwriting’s definition of large in terms of dollar amount (The HOUSE Team will help you understand what is considered a “large deposit”)

How do “Large Deposits” need to be documented

There are 2 simple steps to properly documenting Large Deposits:

1. Borrower must provide a copy of the cancelled/cleared check that was deposited

2. Borrower must provide a simple letter explaining the source of the deposit

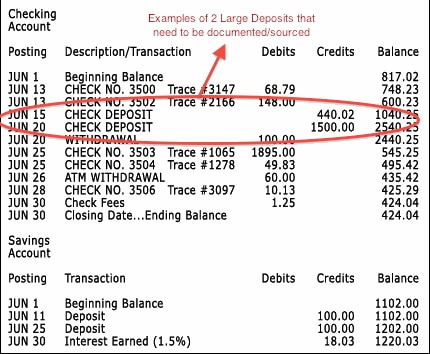

Large Deposit Sample