While the Fed Funds Rate and Mortgage Rates tend to trend together over time, the former does not directly impact the latter. However, the Fed Funds Rate does directly impact short term lending rates.

What is the Fed Funds Rate

In short, the Fed Funds Rate is the rate at which banks lend money to each other overnight. This in turn impacts the rates banks charge on shorter term financial products. For example, the following are impacted by the Fed Funds Rate:

- Credit Card

- Auto Loans

- Home Equity Line’s of Credit

- Personal lines of Credit

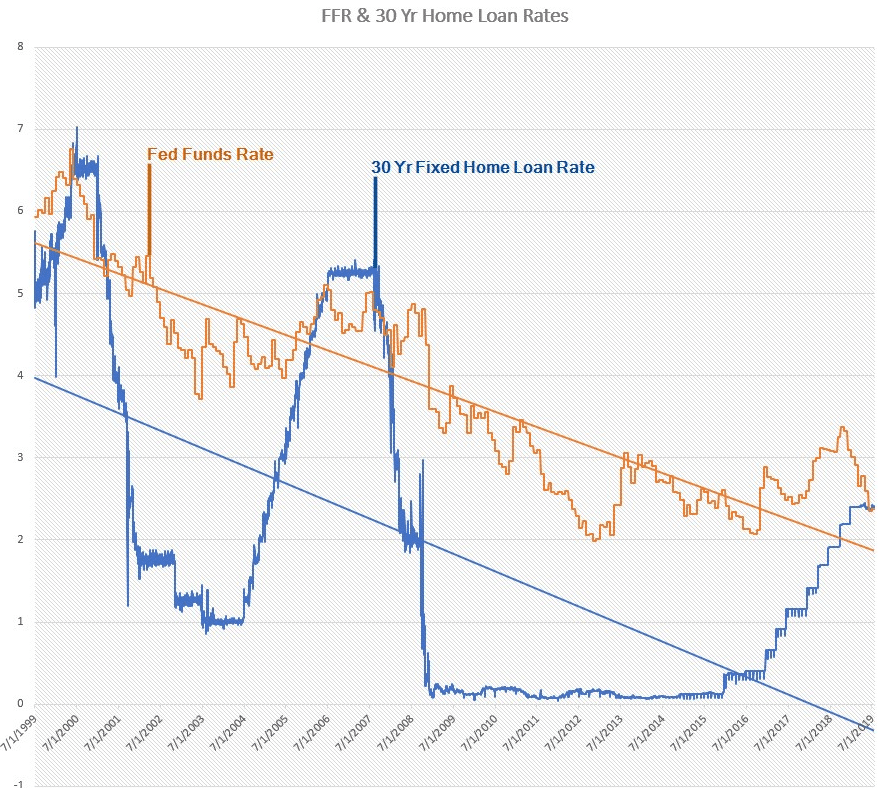

However, fixed mortgage rates are NOT directly impacted by the Fed Funds Rate. While over time, both rates trend in the same direction there is no direct connection. Take a look at the chart below. Between 1999 and 2019 the 2 rates do not track together. If the 2 rates were connected the 2 lines would move harmoniously.

On the other hand both rates trend lines are nearly identical. Over time, the ups, downs and in betweens of both rates moving end up being nearly equal. To summarize:

- Long term – the 2 rates follow a very similar path

- Short term – the 2 rates are not directly connected

However, to better understand how these 2 rates relate, let’s look at what impacts fixed mortgage rates.

What Moves Fixed Mortgage Rates

Mortgage backed securities move mortgage rates. Also known as mortgage bonds, this is all that pushes rates around. Many believe the answer is Treasury Bills. Typically, T-Bills and mortgage rates move in tandem. However, one is NOT dependent on the other. In fact, several times in history the 2 moved in opposite directions. T-Bill is a good indicator of mortgage rates but not they are not the driver behind of mortgage rate movement.

Completely exploring and explaining how fixed rate mortgages go up or down is complex. While one factor – mortgage bond pricing – dictates the direction of mortgage rates a multitude of things influence mortgage bond movement. In other words, in totality several complex factors directly and indirectly impact mortgage interest rates. For example:

- Economic news (for ex: stock market direction, unemployment and new jobs)

- Inflation related news

- Global news

- Political news

- Servicing value of a mortgage (falling rates lowers value of mortgages to an investor)

Where Fed Funds & Mortgage Rates Intersect

In general, mortgage rates fall when there is uncertainty over economic growth. The Fed tends to cut interest rates when they have concerns over the economy. As a result, when you see mortgage rates fall and it happens to line up with a Fed Funds rate it is because the market/Wall Street is reacting to economic concerns and not directly to the Fed Rate Cut.